Bullish Case

- Earnings forecasts for 2017 are out, and they show double digit growth?

- The fear of a U.S. recession has been lowered by many investors.

- Interest rates, inflation and oil prices remain low, and are good for the economy and asset prices.

- Oil and many commodity prices have recovered relieving concerns of defaults from energy and commodity related companies.

- The dollar is stabilizing, causing earnings forecasts to improve, especially for 2017.

- Credit spreads are improving, narrowing

Bearish Case

- China and the global economy are slowing

- China’s slowing and change of focus from investment, manufacturing and exports to a consumer and services focus are causing disruptions in the Chinese and global economies, especially resource based economies.

- Latest terrorist attacks are bad for the European Economy, and its anemic growth

- Isis and the Middle East create uncertainty, instability and danger

- Earnings continue to be revised downward for 2016

- Markets are now overvalued

- Global central banks, and especially ours, are running out of effective monetary bullets to help our economies, especially if we have a global recession or major financial crisis

- The collapse in oil prices is hurting many energy based economies (Russia, Mexico, Venezuela, Nigeria….). Low oil prices are also hurting the U.S. energy industry and we’re seeing more layoffs, bankruptcies, and banks are worried about more energy loan defaults.

- This economic and market cycle is maturing and may enter a decline phase (some indexes have entered decline, bear markets).

- The Fed may raise interest rates at least one more time this year. This could be disruptive to the debt and equity markets.

- The elections are causing concerns among economists, analysts and investors.

Below is the latest predictions for the elections from Pivit:

According to Pivit, the Democrats are improving the chances of winning the White House.

The Dollar

The dollar is rarely taken into consideration when U.S. consumers and individual investors make purchasing or investment decisions. One of the reasons for this is because many of the services and products we consume are denominated in dollars. Also, most of these products and services are generated and consumed in the U.S., so the dollar’s movement isn’t as important as it is in other countries. Most countries have to import products and services and those products, services many times are denominated in dollars, so the dollar is important to those countries.

Today, the dollar does matter for investors, especially for our multinational companies who compete overseas. If the dollar is strong, and when they bring back their foreign profits and convert them to dollars they will have losses in the conversions. Also, a strong dollar will make their goods and services more expensive, as you will need more of a foreign currency to buy a stronger dollar denominated products and services.

Below is a ten-year chart of the dollar index, a basket of currencies of our main trading partners:

After the financial crisis, the dollar fell to about 70. As the economy recovered, the dollar strengthened.

The last few years we’ve seen the dollar accelerate upward. Below are some of the main causes of the dollar’s bullish trend:

- Improvement in the U.S. economy, especially compared to our major trading partners (Europe, Japan).

- The prospect that our Federal Reserve would raise rates making our bonds more attractive that causes foreign money to invest in the U.S. and dollars.

- Many of our trading partners were lowering their rates, to lower their currencies to make their products and services more competitive. Some analysts call this trend “a race to the bottom”.

- The dollar does trade in the futures market. Because of the leverage in the futures market, trends in the leveraged futures markets get exaggerated.

It is normal for the dollar to trade in ranges for long periods of time. For about the last 1 ½ half years, the dollar has traded from around 93 to 100.

There is a chance that rates normalize higher, this could cause the dollar to break above 100. If we go into a recession, the dollar could fall below 93.

The stronger dollar is one of the reasons for weak corporate earnings. Some analysts are increasing their earnings estimates due to a stabilizing dollar.

Major Market Consensus Earnings Estimates

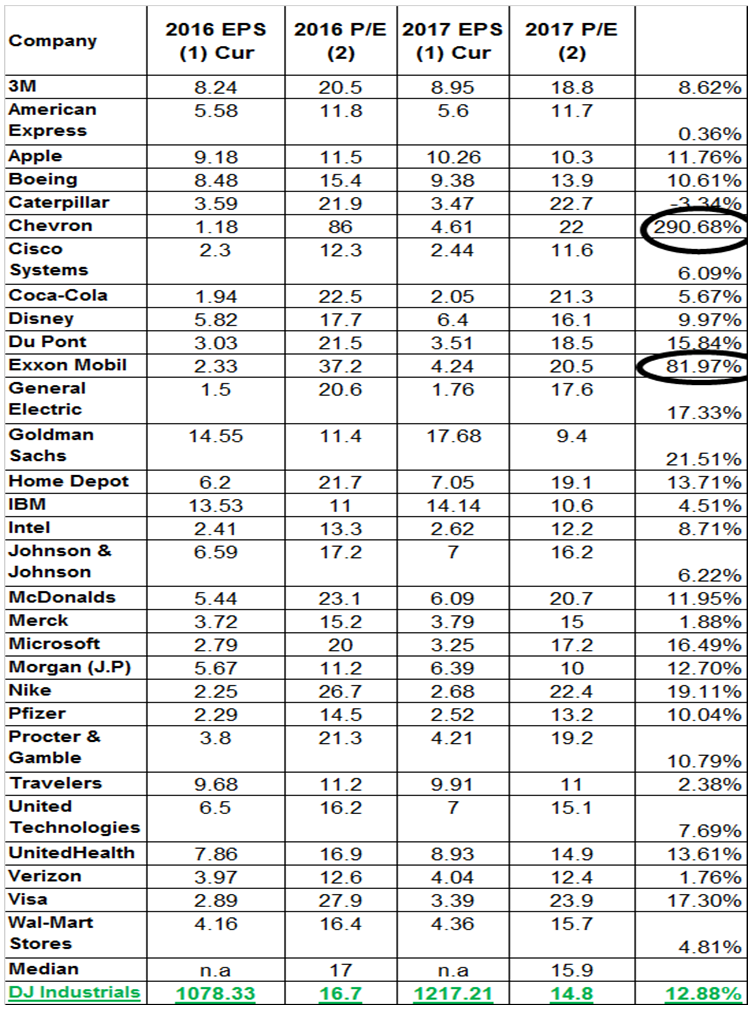

Major market earnings estimates are out for 2017, and analysts see improvement, higher earnings. Below are the consensus earnings estimates for the Dow 30 components:

Analysts see a 12.88% increase in earnings for 2017. Before I change my mind from being cautious, we must take another look at the numbers including looking at similar periods of the market.

If we take out energy companies Exxon Mobil and Chevron, the growth rate is less than half 12.88%, still better growth than what is expected for 2016.

Part of the improvement in earnings is based on the stabilization of the dollar. This may not pan out. Currency losses could be hedged, but the stronger dollar makes U.S. goods and services less competitive, this will not change, and I doubt that earnings will be as rosy as analysts are forecasting.

Also, if we look at last year’s Dow 30 2016 forecasts, we can see that earnings forecasts were near the same levels as forecasts for 2017:

Source: Consensus Earnings Estimates Thomson Reuters, Barron’s, Dan Hassey database

About a year ago, the earnings forecasts were about 1218 and peaked mid-year and have fallen just about every week including this week. Will the earnings forecasts for 2017 also fall overtime? I will follow the forecasts, and let you know in future issues.

In 2008, 2009 we saw earnings forecasts too optimistic, and analysts were dramatically lowering their forecasts during this period:

Source: Consensus Earnings Estimates Thomson Reuters, Barron’s, Dan Hassey database

As the chart above shows, at the beginning of 2008 earnings were forecasted to be 877.28, and were lowered to 353.86 by May of 2009. At the beginning of 2009 earnings forecasts were 1044.54, too optimistic. This is quite normal where analysts are too optimistic and are not good at identifying inflection points in the economy, markets and earnings.

In 2008, actual earnings fell from a peak in 2007 of 824.65 to 178.18 in the 1st quarter of 2009.

Major Market Targets

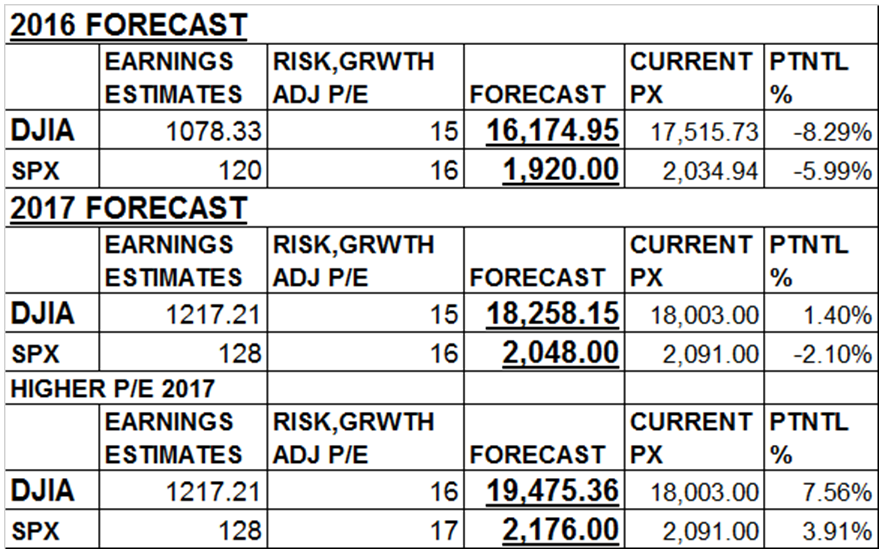

Below are the price targets for the major markets based on the current consensus earnings estimates:

Source:

Consensus Earnings Estimates Thomson Reuters, Barron’s

Source:

Consensus Earnings Estimates Thomson Reuters, Barron’s

If these forecasts are correct (remember there is a trend of analysts lowering earnings estimates), then the markets are overvalued this year and fairly valued for 2017. I use a lower P/E because of the lower growth, higher risks, and the aging of this economic and market cycle.

The last 3 columns I do use a slightly higher P/E for 2017, and if investors do pay a higher multiple (I don’t believe in paying a higher multiple for the reasons listed above) then the markets do have some upside for 2017.

To summarize, it’s too early to believe these earnings and market targets because:

1. Even though the dollar is stabilizing, it will not change the fact the dollar is stronger against other currencies and makes U.S. goods and services less competitive.

2. Analysts are not good at anticipating turning points in the economy and markets, they are normally too optimistic.

3. I’ve learned to pay less for stocks in the late phase of an economic and market cycle.

I remain cautious, unless these earnings forecasts stop going down. The upside is limited compared to the downside.