President Trump believes that deregulation, lower taxes, and infrastructure spending will help the economy grow faster, and his economic agenda could help create millions of high paying jobs for his supporters.

What Factors and Conditions Create Faster Economic Growth?

There are many academic studies that analyze the economic policies, conditions that create faster growth and prosperity in the U.S., below is a partial list:

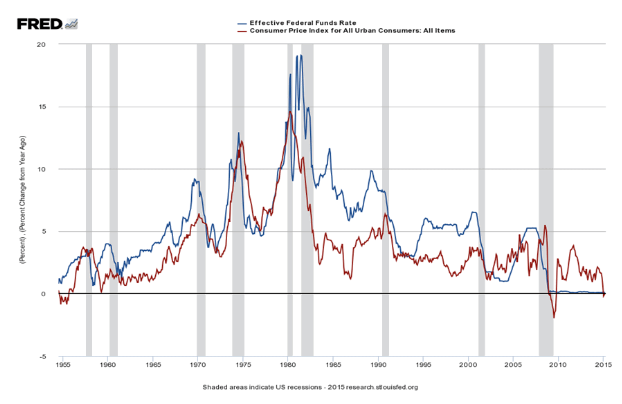

- Inflation and interest rates; both go hand in hand. We have lots of data and history on the impact of inflation and interest rates and the economy. Low inflation allows for low interest rates and low interest rates normally stimulate the economy. High interest rates slow down the economy and many times as the economy slows, the misallocation of capital during the cycle leads the economy into a recession.

\

\

This chart above shows the strong relationship between inflation (red trendline), interest rates (blue trendline) and recessions (grey shaded areas). When inflation climbs so does interest rates and we normally go into a recession. Once we go into a recession inflation falls, and interest rates are lowered to stimulate the economy, and the next cycle starts.

Inflation, interest rates are at historical lows and they have helped our economy recover. But, there is a reversal of the strong stimulative monetary policies and efforts implemented to deal with the Great Recession that started in 2008; the Fed is raising interest rates and they will begin unwinding its $4.5 trillion balance sheet.

Also, there are questions as to whether President Trump will keep Janet Yellen as Chairperson of the Federal Reserve; her term is up next February.

The reversal of monetary policies of this cycle, the questions on who will led the Fed could cause disruptions in the economy and volatility in the markets.

- Low oil prices can help inflation stay low and can help interest rates stay low. If oil prices go up, it’s like a tax on the consumer and takes money out of the consumer’s budget.

- Productivity can help inflation stay low and increase the standard of living. Productivity has stayed low in this economic cycle. Economists cite potential reasons for the slow-down in productivity: lack of capital investment that could enhance productivity, experienced baby boomers leaving the work force, wrong incentives by employers, and decades of industry consolidations creating less competition.

- New technologies and innovation create growth and prosperity: aviation, cars, electronics, the digital revolution and the internet. New innovations, technologies will be difficult to move the needle on our $18 trillion dollar economy, but they could be great investments. Future innovations could come from new drugs and health care innovations, artificial intelligence, self-driving cars.

- Aggregate demand is very important to our economy, especially at the consumer level. Aggregate demand has been lower this economic cycle due to retiring baby boomers, and strapped millennials.

- Americans are ambitious, optimistic, creative and innovative. We have some of the best colleges and universities in the world, and all of this has helped create a dynamic, diverse economy. Unfortunately, the law of large numbers makes it hard to move the needle on an $18 trillion economy despite our country’s many blessings.

We do have low inflation, interest rates and oil prices, but we have historically subpar growth. Review my research article that explains why we have had subpar growth for the last 17 years, and will probably have subpar growth for the foreseeable future. Click here to study the article, Trumponomics, and the New Normal.

There is not a lot of history or research that shows the economic impact of deregulation, but this report does analyze what we do know.

During the presidential campaign candidate Trump said. “I would say 70% of regulations can go.”

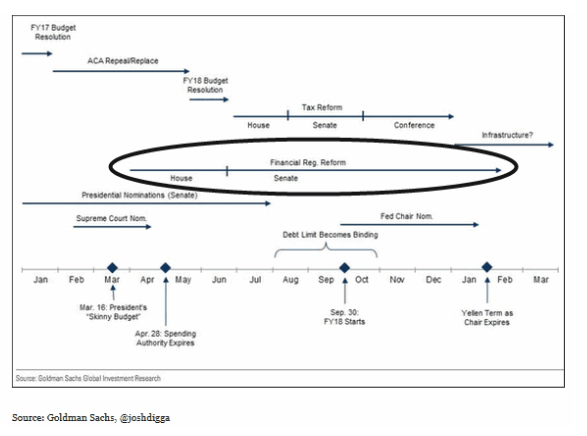

The new administration is behind on its economic agenda. Below is a calendar provided by Goldman Sachs:

The administration’s economic agenda is behind schedule including deregulation. The President has issued a few executive orders to cut red tape.

History of Deregulation and Why It Continues to Grow

If you ask any entrepreneur, CEO they will complain that regulations are expensive and onerous. Healthcare is their number one concern, “unreasonable government regulations” is concern number two.

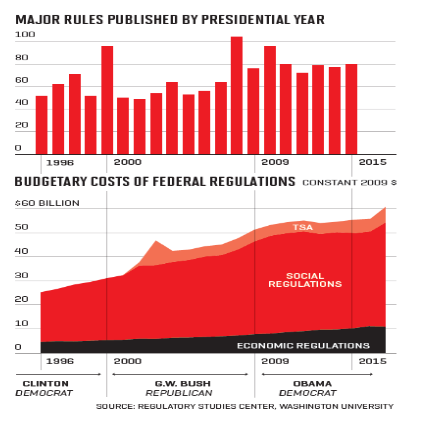

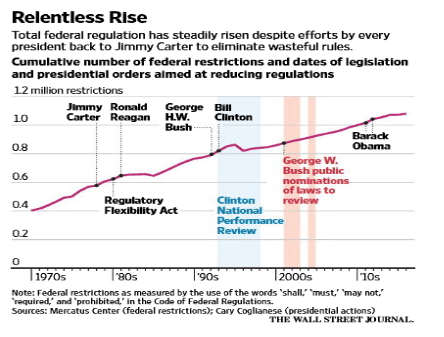

Below are charts that show the history, and costs of regulations, and the many programs under different presidents to reform regulations:

We have an $18 trillion economy, regulatory costs to the economy is about $63 billion. A fraction of the size of our economy.

The Obama administration was one of the most prolific producers of regulations. Most of the regulations came from the Dodd-Frank bill dealing with the financial crisis of 2008 and the Affordable Care Act (Obama Care).

According to my research, the reason why regulation continues to grow include:

- New technologies like drones, and social media cause legislators to write laws reducing the negative side effects of new technologies.

Our economy continues to grow more diverse and complex and does need regulations for the many industries in our economy. - When things go bad e.g. 911, the Great Recession of 2008, the Deep Horizon Gulf of Mexico oil spill disaster cause the public to demand new regulations. Lawmakers don’t create regulations for fun. Regulations occur because of bad events and the public demands remedies.

If we’re honest, if events like Deep Horizon oil spill, bad underwriting practices and the housing collapse in 2008, the technology bubble in the early 2000s, the fraud at Enron, World Com, Bernie Madoff …., didn’t happen we wouldn’t need the regulations.

I have a Registered Investment Advisor license, and our industry is heavily regulated (on both the state and federal level) with licensing, frequent audits, and continuing education requirements. This industry, because of the potentially high remuneration, attracts a certain type of individual (Bernie Madoff, Ivan Boesky, Michael Milken, Wells Fargo….) that the public needs to be protected against.

Bad behavior by a few hurts us all. - Some analysts believe there are too many lawyers in congress and they have a penchant for creating new laws.

- Once a law is on the books they are hard to repeal. Sunset regulations are needed.

We have also learned that when we do away with regulations, overtime something bad happens again, and the public demands better protection. The 2008 financial crisis is a good example. Financial regulations were reduced for many years. Bad things happened, so they’re back again.

I believe if regulations were rolled back, bad things will happen eventually, and the regulations would be brought back. This is the history of regulations. - As mentioned above, there have been many efforts to reduce regulations, but there remains regulations at the state and local levels that are also hard to reform or repeal.

- Big business complains a lot about regulations, but many times they help write the laws through their lobbyists where they add exceptions, exclusions that help their specific companies. Also, some of these regulations create higher barriers to entry creating less competition that benefit the big businesses that help write the laws. Businesses don’t like losing these exceptions, benefits and this is one of the reasons why it’s hard to reduce regulations; businesses will fight hard to protect their loopholes with the help of their lobbyists.

Will President Trump be successful in reducing regulations? We all hope so. History is against him, and his economic agenda is behind schedule.

Summary and Conclusion - Entrepreneurs and businesses agree that there are too many regulations and it would help the economy if they were reduced.

- There is not much history on what happens to economic growth when regulations are reduced, because it’s never happened at a significant level.

- Every president since Carter has had a program to reduce regulations, but few made progress.

- There are reasons for the proliferation of regulations overtime: crises occur and the public demands it; we have a complex and diverse economy that is hard to protect; new technologies; Washington is full of lawyers and lobbyists; increased regulations occur at the federal, state and local levels.

- It is a worthwhile goal to reduce regulations, but most presidents fail at significantly reducing red tape. President Trump will probably run into the same problems past presidents have. Also, his economic agenda is behind schedule and it’s not clear when he will get to deregulation. He has issued a few executive orders to cut red tape.

The question for the public and economy is - what is the right balance for protection, safety and economic stability and growth, innovation and prosperity. Going back to the financial services industry - do we want a safe, stable financial and economic system or do we want conditions with less regulations, with the potential for higher growth but that inevitably end in debacles like the 2008 Great Recession, the savings and loan crisis of the late 1980s, the Orange County bankruptcy in California, the 1987 market collapse….

The same balance is needed in most industries: pharmaceuticals, retailing, aerospace, airlines, trucking, autos, housing, utilities, lodging, restaurants, energy, biotechnology…..