When I tell people that I’m an investment professional, and that I recommend and own stocks. Many people say, “isn’t that gambling”. Most of the public does not know the difference between investing, speculating, and gambling.

The aim of this article is to define and differentiate: “investing”, “speculating”, and “gambling”.

If you’ve taken an investment class as an undergraduate or graduate student, you were probably assigned Investments by William F. Sharpe (Stanford University Finance Professor Emeritus and Nobel Prize winner in Economics).

Investing, Speculating, Gambling Defined

Dr. Sharpe’s book defines and explains investing, speculating, and gambling.

Investment is sacrifice of certain present value for (possibly uncertain) future value.

Examples:

- Investing in oil stocks that have significant reserves that the market is undervaluing, with the prospect that oil prices will be higher in the future. The last several years, acquirers have been paying from $30 to $50 a barrel for a company’s reserves. Many of the companies that I follow, the market is pricing reserves on average about $10 a barrel. Many of these companies are undervalued.

Investors in oil stocks essentially own oil and natural gas reserves.

- Investing in companies that pays a growing dividend (today it may be paying 3%,at current growth rates the yield could be 7% to 10% in 10 years). As the dividend grows, the stock becomes more valuable and normally appreciates.

Speculate: To assume a business risk in hope of gain; especially: to buy or sell in expectation of profiting from market fluctuations.

Example: A news event makes bitcoin spike, but after a few days and the lack of news, bitcoin collapses. Speculators wait for the next news event.

Gamble: To bet on an uncertain outcome.

Example: Betting on a flip of a coin. In gambling, probability, chance is the important variable.

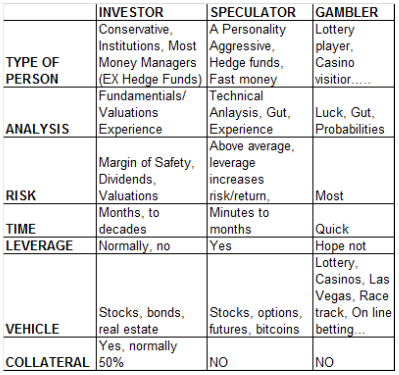

Below is a grid that helps delineate the differences between investors, speculators and gamblers.

Let’s go through the different rows and columns:

TYPE OF PERSON

In actuality, a person can be all three. A person could have the majority of his/her portfolio in conservative investments, can speculate with a small portion of their portfolio, and take a trip to Las Vegas or local casino (here is Southern California, there are many to choose from) every once in a while.

Most institutional investors (by definition) are conservative because of their charters and fiduciary responsibilities, and they tend to stick to conservative investments.

Many hedge funds and high frequency traders speculate in the markets. Individuals that speculate in the options, futures or other markets are normally more aggressive and have A type personalities. They also tend to leverage their positions by borrowing money, use margin to speculate. They want a higher risk/return proposition.

All types gamble: rich/poor, young/old, men/women….

Analysis

Fundamental Analysis is taught at the major universities (Stanford, University of Chicago, Wharton, Columbia…) and when investment students graduate, they eventually manage institutional, and other large pools of money. One aspect of fundamentals is valuations: how much is an asset worth. Again, if a company wanted to acquire another company, how much should they pay for it? Technical analysis and gambling would not be helpful to determine a valuation price.

If a company wanted to sell itself, they would go to Wall Street, and investment bankers would use fundamental analysis to determine how much they should sell their company for. Again, an investment banker would not use technical analysis, speculation, or a dart/gamble to determine a price.

Most institutional money managers including mutual fund managers use fundamental analysis.

Investors try to buy undervalued assets and sell at intrinsic (according to the bible of fundamental analysis Security Analysis “intrinsic value seeks to determine what a stock is worth if properly priced in a normal market”) or overvaluation.

Most speculators time horizons are short-term so technical analysis (also known as market timing, price analysis) is more important where support and resistance levels or moving averages can help you with an entry or exit price. Experience can also be helpful in speculating, the more the better. There are very few major universities that teach technical analysis. There are no mutual fund managers that exclusively use technical analysis, although some do use technical analysis to help them with their entry and exit points. In the past, there had been mutual funds that use technical analysis exclusively, but they no longer exist.

Normally, speculators buy oversold and sell overbought situations, or buy strength and ride the strong trend.

What you really need in gambling is luck, to beat the odds.

Risk

In fundamental analysis there is a concept of “margin of safety”, meaning that an investor should only buy a company when its current price is below its intrinsic value, according to Security Analysis (one of the best books on fundamental analysis). They also tend to like dividend paying stocks that can pay you for investing and that the dividend income can grow over time. The dividend yield can also provide a cushion, the lower the stock goes, the higher the dividend yield and the more attractive the stock becomes. Also, most mutual funds, large pension, and endowment funds do not allow leverage in their charters.

Speculators will use leverage increasing risk. Futures have significant leverage embedded in their contracts. Options control an asset with a small amount of money, leverage. Speculation can work because of its potential higher returns if: fundamentals are also used, experience is used, hedging or cost reduction is used (e.g. using spreads), mastering and sticking to a discipline.

In gambling you risk your entire capital on your bet. If the bet goes against you, you lose your capital. If you win, the return on capital is much greater than investing.

Time

If an investor owns a stock that pays a dividend and it grows every year, why would he/she want to sell the stock? The same for a bond, it pays consistent interest and at maturity you get your principal back, especially if they’re retired and need the income. Investors have a longer time horizon that could be decades.

An axiom of speculators is to let your profits run, and to cut your losses. So a profit could be made in minutes, or could extend for a few months until it consolidates or retraces. A loss could occur quickly so an exit could be very quick, especially if a stop loss is used.

For gambling, a flip of a coin could take a few seconds and the gamble is over.

Leverage

Most investors use little leverage.

Speculators use leverage. Leverage is embedded in options and futures.

Leverage should not be used in gambling.

Vehicle

Investors will invest in stocks, bonds, cash equivalents, real estate, mutual funds, ETFs, managed accounts, venture capital funds….

Speculators buy stocks, real estate, ETFs, options, futures.

Gamblers buy lottery tickets, visit: race tracks, casinos, online gambling sites….

Collateral

If you went to a bank or a brokerage firm, they will lend you money against your stocks and bonds. The money could be used for any reason.

Speculators do not hold most marketable securities long enough to borrow against. A bank or broker will not let you borrow against an options or futures contract.

A traditional lender will not let you borrow against a wager.

Are You an Investor, Speculator, or Gambler?

As mentioned above, most people will invest, speculate and gamble.

There are many variables that determine if a person will predominately be an investor, speculator, or gambler: investment knowledge, risk temperament, income level, net worth, educational level, investment experience, parents.

I’ve found that the more a person has experience and knowledge regarding economics, business and investing, the more their willing to assume risk and do better as investors.